Fredericksburg bankruptcy attorney Options

Find out more with regard to the debts which have been "discharged" or removed when filing for Chapter seven bankruptcy safety.

Debt resolution method success will range with regards to the individual condition. As a result, credit card debt resolution services aren't appropriate for Every person. Not all debts are qualified for enrollment. Not all individuals who enroll finish our method for numerous reasons, like their capacity to conserve sufficient cash. Discounts ensuing from successful negotiations may well bring about tax penalties, make sure you check with with a tax professional with regards to these consequences. Using the financial debt settlement products and services plus the failure to produce payments to creditors: (1) Will probably adversely have an impact on your creditworthiness (credit rating score/credit history rating) and help it become more durable to get credit history; (2) Might end in your becoming subject matter to collections or becoming sued by creditors or debt collectors; and (three) Could boost the sum of money you owe mainly because of the accrual of expenses and curiosity by creditors or personal debt collectors.

The debtor's present-day regular profits is made use of to ascertain if the debtor can file for Chapter 7 bankruptcy, among other matters.

No two bankruptcies are alike. To file for bankruptcy credit card debt aid in Fairfax County VA, you need a bankruptcy law firm experienced in all similar apply areas of VA bankruptcy legislation, giving leading lawful guidance.

It ought to. Amongst the greatest black marks with your credit rating rating is getting late or skipped payments, and consolidating your whole debt into one particular month to month payment causes it to be extra most likely you'll shell out in time.

A group of legal professionals is standing by throughout the clock so you can end any legal situation speedily and proficiently.

You might need to have a specified number of unsecured personal debt to be acknowledged into a financial debt consolidation system (one example is, $seven,five hundred or maybe more). For those who're battling to keep up Using the bare minimum payments with your credit cards and loans, you might be a terrific applicant for credit card debt consolidation.

But much more than that, you would like Fairfax VA bankruptcy attorneys with compassion to operate aggressively in your bankruptcy circumstance – and commitment into the Fairfax VA Group.

He was knowledge, empathetic and respectful of my problem. He educated all over the method and produced it seamless. Tannya H. View whole critique right here

Emergency bankruptcy filings are occasionally required. Bankruptcy is an enormous selection that needs to be very carefully regarded as. On the other hand, from time to time it is the greatest transfer to your monetary scenario, and see this website in some cases you would like bankruptcy defense right away!

Move four – File Bankruptcy Petition – Your Fredericksburg bankruptcy attorney will file a bankruptcy petition with accompanying sorts listing your income and bills. When you've got finished submitting the petition and declaring your exempt property, an automated stay goes into influence and helps prevent creditors and collection organizations from pursuing debt assortment initiatives against you, which includes foreclosure proceedings, eviction, repossession of cars and garnishment of wages. The remain will continue to be in outcome while the bankruptcy is pending.

These added specifics enable our attorneys to realize a deeper knowledge of website here the specifics of your respective circumstance

You'll have to Reside in this spending plan for as much as five decades. Throughout that time the courtroom will find more continuously Test your spending, and can penalize you severely when you aren't next the plan. Sound like enjoyable? To best it off, it is going to stay on your record for seven several years.

Inside one hundred eighty times look at this now prior to filing for bankruptcy, it's essential to total a credit rating counseling course. The U.S. Trustee’s Business office must approve the training course, and it may possibly cost amongst $twenty five and $35 with the program. If investigate this site You can't find the money for a credit history counseling course, chances are you'll qualify for bargains or perhaps a free of charge system.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Kane Then & Now!

Kane Then & Now! Bo Derek Then & Now!

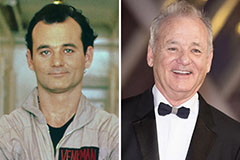

Bo Derek Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!